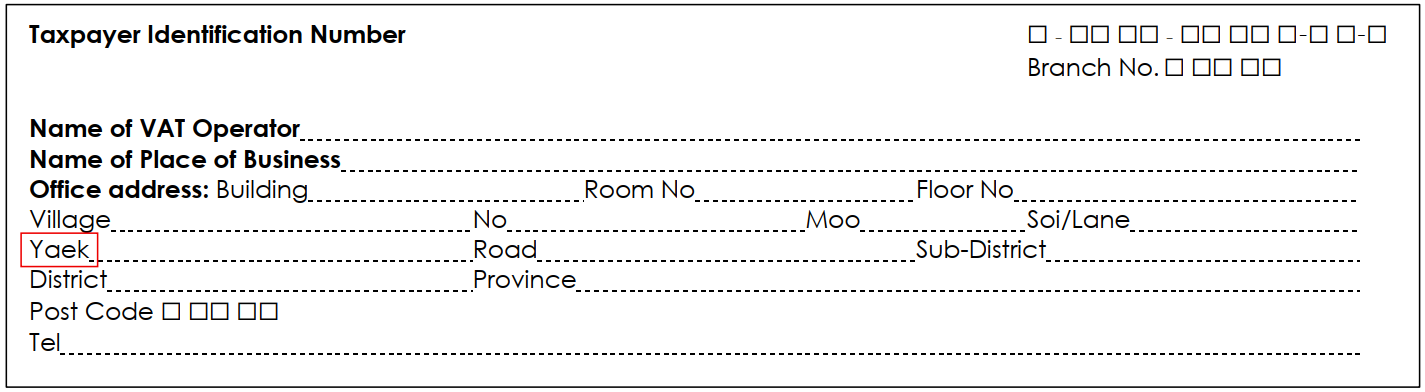

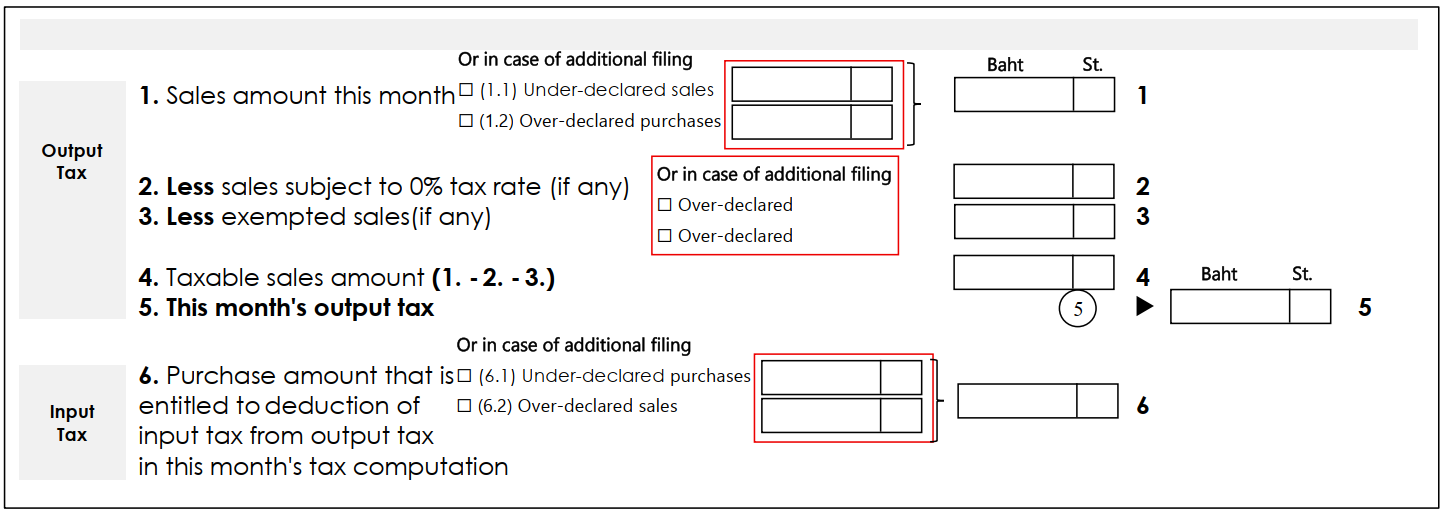

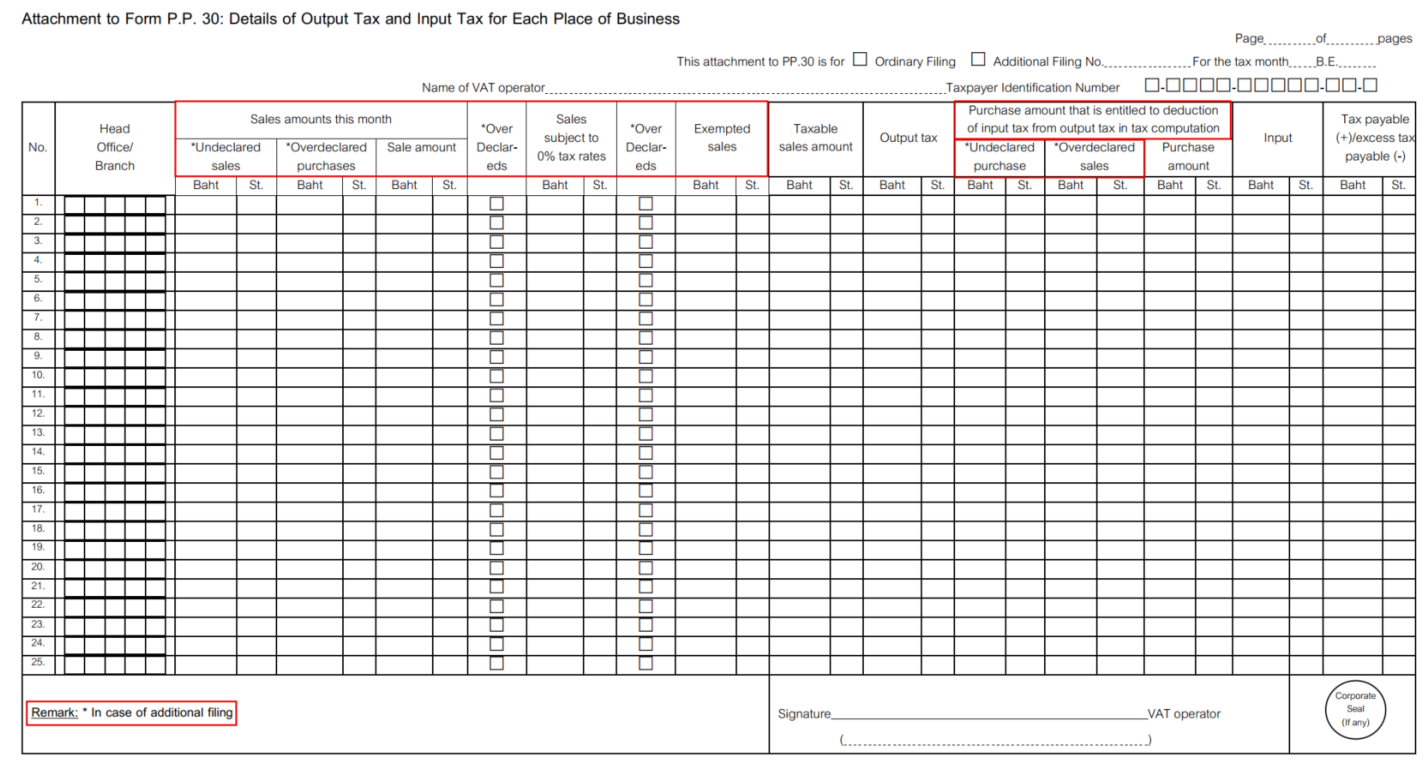

The Thai Revenue Department (“TRD”) has announced updates to the monthly VAT return form (“PP. 30”) and its attachment, effective from 1 March 2026. The revised form introduces several changes aimed at improving data accuracy, tax computation clarity, and the tax refund process. The key updates are summarized below, and the changes to PP. 30 and its attachment are highlighted in red boxes in the figure below.

Key Changes to PP. 30

1. Expanded Address Details

There is now “Yaek” (intersection) field for the taxpayer's principal place of business or their branch office.

2. Enhanced Tax Computation Section

Additional fields to fill out the amount for under- and/or over-declared sales and/or purchases have been introduced for additional filings including checking the boxes for over-declared sales subject to 0% tax rate and over-declared exempted sales. These fields require a clearer breakdown of tax amounts by section, allowing for more accurate tax adjustments.

3. Tax Refunds via PromptPay

Going forward, tax refunds can be processed via PromptPay as a primary payment channel. Taxpayers are required to register PromptPay account with their financial institution for their convenience to receive cash tax.

4. Revisions to the Attachment

The attachment now requires more detailed disclosures, e.g. under- and/or over-declared sales and/or purchases, to be in line with the P.P. 30 form, when reporting changes in sales and purchases in additional filings. In case of original file, the details of sales subject to 0% tax rate and exempted sales are required to be presented.

(Source: The Revenue Department’s website)

Author’s Note:

Given the increased level of details required to be declared in the tax computation section of P.P. 30 and its the attachment, the TRD is better positioned to identify not only the amounts reported, but also the underlying reasons for such amounts, whether arising from under-declared and/or over-declared sales and/or purchases.

As a result, the TRD can more easily trace these adjustments back to specific transactions or categories of transactions and determine whether similar adjustments recur across multiple periods or branches.

Taxpayers should be aware that the TRD is developing databases and collecting taxpayer-specific information, making it easier to identify tax risk profiles and detect areas of non-compliance. As such, regularly reviewing tax compliance has become increasingly important.

[Contact Person: Ms. Thirapa Glinsukon, Partner and Ms. Susama Thaveesin, Director]