More than a decate of the transactions, it has come to an end when the Supreme Court overturned previous rulings of the Central Tax Court and the Specialized Appeal Court, resulting in imposing personal income tax (“PIT”) shortfall together with penalties and surcharges of totaling THB 17.6 billion on the former prime minister Thaksin Shinawatra, relating to the sale of Shin Corporation Public Company Limited (“Shin Corp”) shares.

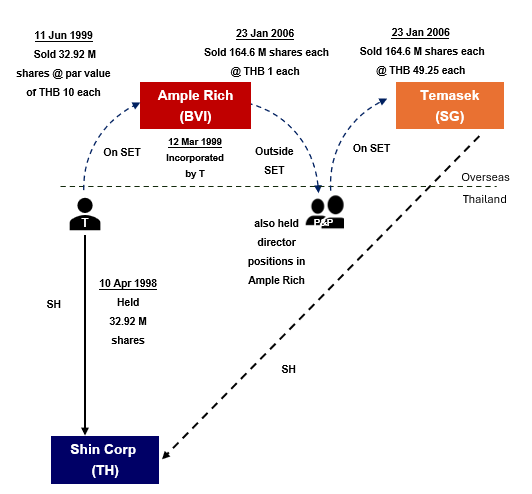

Background started from June 1999, Thaksin sold his 32.92 million shares in Shin Corp at a par value of THB 10, under the Stock Exchange of Thailand (“SET”), to Ample Rich Investment Limited (“Ample Rich”), a company established by Thaksin and incorporated in the British Virgin Islands (“BVI”).

Later in January 2006, Ample Rich sold all its shares in Shin Corp of 164.6 million shares each, outside SET, to Panthongtae and Pintongta Shinawatra, Thanksin’s son and daughter, at just THB 1 per share.

Instantly on the same date, Panthongtae and Pintongta sold all of their shares in Shin Corp, under SET, to Tamaesek Holdings (Private) Limited (“Temasek”), a company incorporated in Singapore.

Gains derived by Panthongtae and Pintongta on the sale of shares in a company listed on the SET, i.e., Shin Corp, are exempt from PIT. However, the Thai Revenue Department (“TRD”) issued summons to Panthongtae and Pintongta in April 2007 and then assessed PIT (including penalty and surcharge) of THB 17.6 billion.

Key elements for the Supreme Court to reverse the previous rulings by the Central Tax Court and the Specialized Appeal Court are as follows:

1. Not having commercial reason

There was no commercial reason for Ample Rich, operating as an investment company, to sell shares in Shin Corp at THB 1, against THB 49.25 on SET, by far below the market price.

Therefore, such transaction generated assessable income (on the price difference) to the individuals who were directors and shareholders of Ample Rich under Section 39 and being subject to PIT under Section 40 (2) of the Revenue Code (“TRC”).

2. Acting on behalf of undisclosed principal

Panthongtae and Pintongta were acting as nominees on behalf of Thanksin. Hence, any legal act the nominees had undertaken in regards to Shin Corp shares would also bind Thanksin as (undisclosed) principal.

Consequently, the summons issued by the TRD to Panthongtae and Pintongta within the time limits would also bind Thaksin as the undisclosed principal and the TRD had the power to assess PIT on Shin Corp share sales transactions.

3. Lacking of tax morality/integrity

The legal purpose that issued prevention measure nominee arrangement is to prevent Thaksin from holding shares in Shin Corp (in telecommunication business) when holding political position.

Accordingly, the nominee arrangement was leading to the lack of tax morality/integrity and conflicting to the purpose of the TRC in which aiming to collect accurate tax. In addition, the arrangement had no commercial reason except for gaining own tax benefits in which considering as strongly improper act under the law.

Based on the reasons above, the Supreme court also ruled that there was no reason to waive and reduce the tax penalty and surcharge.

(Source: The Supreme Court Case No. 6890/2568, released on November 17, 2025)

Author’s Note:

It is crucial to understand intention and interpretation of the laws. The TRD is looking through the form of transactions, and focusing on collecting tax based on the true substance of the transactions.

It is also important to emphasize that nominee arrangement will not necessarily protect the beneficial owner under tax avoidance purposes.

[Contact Person: Ms. Thirapa Glinsukon, Partner and Ms. Susama Thaveesin, Director]