New Interest Rate Scheme

Written by Mr. Monchai Varatthan

Government recently amended the Civil and Commercial Code (“CCC”) lowering statutory annual and default interest rates in place since 1925. The new rates are effective as from 11 April of this year.

The amendments are intended to improve fairness for debtors and set rates in line with current economic conditions. The changes also supplement Bank of Thailand interest rate measures implemented in 2020.

This article discusses the changes.

Past Interest Scheme

Before 10 April 2021, a creditor could charge annual and default interest at any rate within the 15% maximum. Where a written agreement does not specify an annual or default interest rate, the statutory rate of 7.5% would apply. Government, however, deemed the 7.5% rate as too high compared with fixed deposit account interest rates (e.g. 0.5%-1%) or minimum lending or retail rates (e.g. 5.75%).

Fairness of default interest rate calculations also came under scrutiny. For example, where a debtor defaulted on one installment, the default interest would apply to the entire outstanding balance, not only on the default installment.

New Interest Scheme

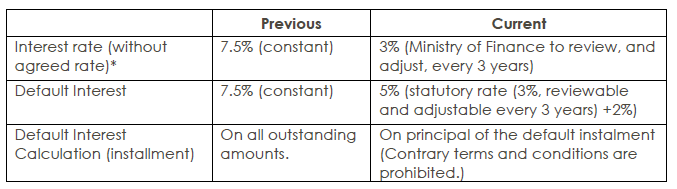

On 10 April 2021, government enacted the Emergency Decree Amending the CCC, B.E. 2564 (“Decree”) amending statutory rates and calculations for annual and default interest on installments. The changes are as follows:

1. The Decree reduces statutory, annual interest rates rate from 7.5% to 3% on agreements that require interest payments at unspecified rates. The Ministry of Finance will, every three years, review the statutory interest rates and adjust them to the closest average lending and deposit rates of commercial banks.

2. The Decree amends annual default interest rates from 7.5% to the statutory rate plus 2%, currently 5% (3%+2%) where agreements do not specify a default rate.

3. The Decree prohibits interest compounding during the default period. However, a creditor can claim other damages, if proven.

4. Where a debtor misses an installment payment, the creditor can only charge interest during the default period on the principal due for that period. Terms or conditions contrary to this rule are void.

For example, one borrows Baht 1 million and agrees to 10 monthly installments of Baht 100 thousand, with annual interest and default interest at 15 percent. If the debtor fails to repay the sixth installment, the creditor can only charge default interest on the installment in default, i.e. Baht 100,000 x 15% x 30/365, only. The creditor cannot charge default interest on the entire outstanding debt (500,000 x 15% x 30/365.)

Key Amendments to the CCC

*Where the parties agreed on interest and default interest rates, such rates will apply.

Legal Implications for Agreements & Court Cases before 11 April 2021

- Amendments will apply to debts due or in default as from 11 April 2021, regardless of whether the relevant agreement was entered into before 11 April 2021. Debts that do not specify interest rates are subject to 7.5% interest rate until 10 April 2021. The 3% rate will apply as from 11 April 2021. New calculations of default interest rates (if not specified) will apply as from 11 April 2021.

- Amendments, in any case, will not affect interest rates already specified in agreements. The amendments would not affect court cases filed and adjudicated before the effective date of the Decree. Debtors can, however, cite these amendments to the courts during appellate stages.

- Amendments would not affect a creditor’s right to terminate the particular agreement. The creditor can still claim all outstanding debts from the debtor in court.

Other Measures Related to Interest Rates

Government and its Bank of Thailand issued measures to ease debt burdens for both companies and individuals, such as:

1. Reduction of policy interest rates from 1.25% to 0.5% for a period of two years from April 2020 so that banks can reduce their minimum retail rate (MRR) by 1%.

2. Request for financial institutions to reduce annual credit card and personal loan interest rates from 18% to 16% and 28% to 24%, respectively from 1 August 2020.

3. Default interest: only be charged on the principal in default from 1 May 2020; and be calculated at the contractual rate plus 3% per annum as from 1 April 2021.

4. Repayment reduced to the next longest outstanding amount, as from 1 July 2021.

Author’s Note:

These amendments to the CCC intend to improve clarity and fairness for creditors and, particularly, debtors. However, issues remain as the new statutory rates only apply where parties do not agree, in writing, to interest rates. Further, the 15% maximum annual interest rate, arguably excessive, remains. Government should review whether the 15% maximum annual interest rate on loans is appropriate by considering costs of lenders and the affordability of the debtors.

Further, there is still no limit on default interest. Courts still have discretion whether default interest is excessively high, or enforceable for only where reasonable. Therefore, when entering into an agreement, one should use the new statutory and default interest rates as a basis when negotiating. Parties can then agree to adjust rates in line the economic circumstances to achieve clarity, certainty, and fairness for both.

Law Talks 2021