Thailand is positioning itself as a notable player in Southeast Asia’s electric vehicle (EV) market, offering both opportunities and challenges for businesses evaluating expansion. With supportive government policies, strategic regional advantages, and a commitment to EV development, Thailand is shaping its role in the evolving landscape. However, understanding the country’s current economic conditions and market dynamics is essential to assessing its potential for long-term success.

1. Geopolitical Tensions and Strategic Shifts

Global trade tensions, including the US-China trade war, have created uncertainties for manufacturers reliant on international supply chains. Thailand’s proximity to regional markets and investor-friendly initiatives, such as tax incentives and land ownership privileges in the Eastern Economic Corridor (EEC), offer an alternative location for production. These policies aim to attract foreign investment, as companies explore options to diversify and stabilize their operations.

2. Pressures and Short-Term Market Dynamics

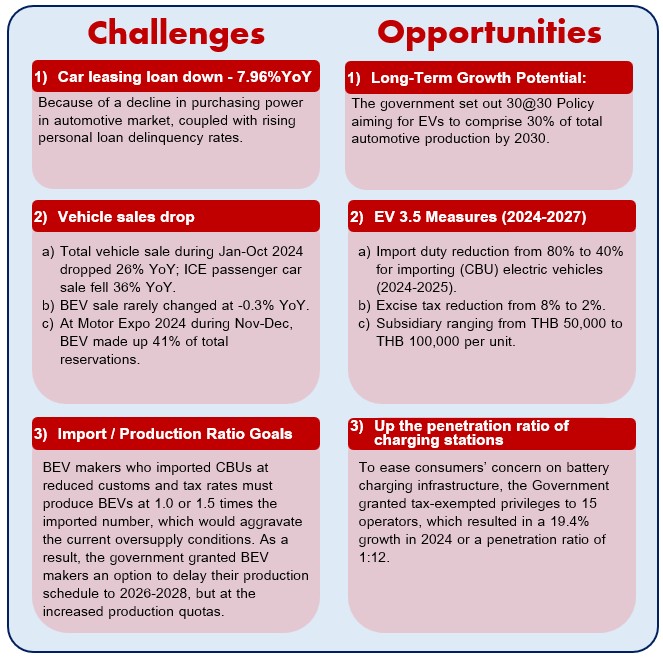

Thailand’s EV sector faces notable short-term challenges. A weakened domestic economy, coupled with rising personal loan delinquency rates, has led to reduced consumer purchasing power, reflected in an 8% decline in car leasing loans and a 26% drop in car sales during the first ten months of 2024. Additionally, imports of Battery Electric Vehicles (BEVs) under government incentives have temporarily oversupplied the market, adding competitive pressure for local manufacturers. In response, the government has eased production quotas to manage market saturation while encouraging long-term growth.

3. Long-Term Vision and Commitment to EVs

Despite short-term hurdles, Thailand has demonstrated a clear focus on becoming a regional EV leader. Policies like EV 3.5 provide excise tax reductions, import duty exemptions, and subsidies to encourage investment in the EV ecosystem. Infrastructure development is a key priority, with the number of charging stations increasing by 20% in 2024. Thailand’s “30@30” vision, aiming for EVs to account for 30% of production by 2030, highlights its long-term commitment to sustainability and automotive innovation.

Conclusion

Tightening car loans would continue to drag down car sales in 2025, resulting in short-term oversupply in the automotive industry. As a result, the government will offer current EV carmakers an option to relax the EV production target. In the long-term, Thailand’s ambitious 30@30 green policy, coupled with various tax and non-tax incentives, would support promising growth of the EV car industry.

[Contact Person: Mr. Phongnarin Ratarangsikul | Partner]